Looks like Mai TT is having a tough time in the UK with reports of women in the UK boycotting her shows. Reports circulating on social media are that Mai TT was sent to her cousins house after she started having issues with Zizoes sister. Reports are that Mai TT was not helping with chores and it brought tension and was told to leave.

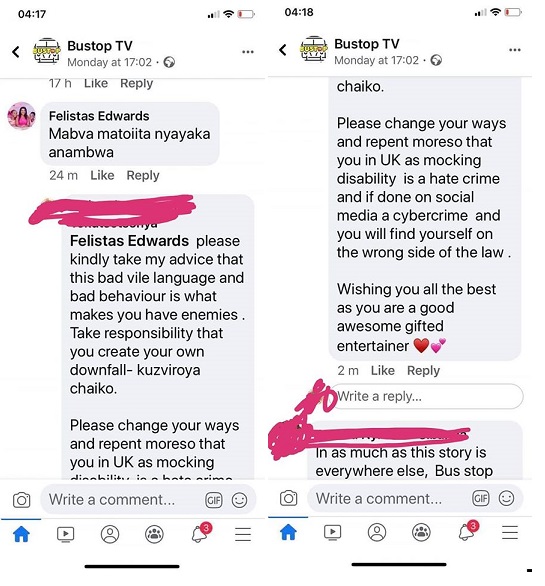

Another story coming out is that Mai TT and Zizoe had a contract to pretend like they were dating until Zizoe moved to the UK but the two ended up falling for each other. Mai TT has been fighting with her fans and some are calling her rude and not lovable. this resulted in some fans reporting her to the UK home office for working in the UK but not paying taxes.

Reports are also coming that Mai TT had shows scheduled till June and with all the drama on social media some of these shows have been cancelled and she may return wo Zimbabwe soon.

Related Story

Mai Titi in trouble in the UK after being reported of tax evasion. Comedian Mai Titi has been reported to the United Kingdom immigration department for conducting business in the country with a visitor’s Visa resulting in her invading paying taxes.

In a statement, UK based Zimbabwean Sabena Anesu Rwizhi writes a report to the UK Home Affairs Office enquiring if Mai Titi paid taxes. She said: “I have written to the UK Home Office seeking clarification regarding Felistas Murata’s UK visits earning cash.

And also bragging that she is making the money at work in the UK. I’m not sure if she should be paying tax in Zimbabwe or the UK.” “She seems to be earning more than Zimbabwe teachers but teachers’ pay tax. There are more like her who should be investigated and assessed if they are paying tax wherever they should be paying the tax to.”

However, Mai Titi uploaded a video of herself bragging that she had made £3000 after performing in Birmingham. She also said that by the time she returned she would have bagged over £15 000 and would be proceeding to Australia to host shows. Last year Mai Titi confirmed that she was going for a business trip where she will engage her huge clientele in the UK.